When it rains, it pours.

That adage might be overused, but nowhere is it more true than in the collectibles market.

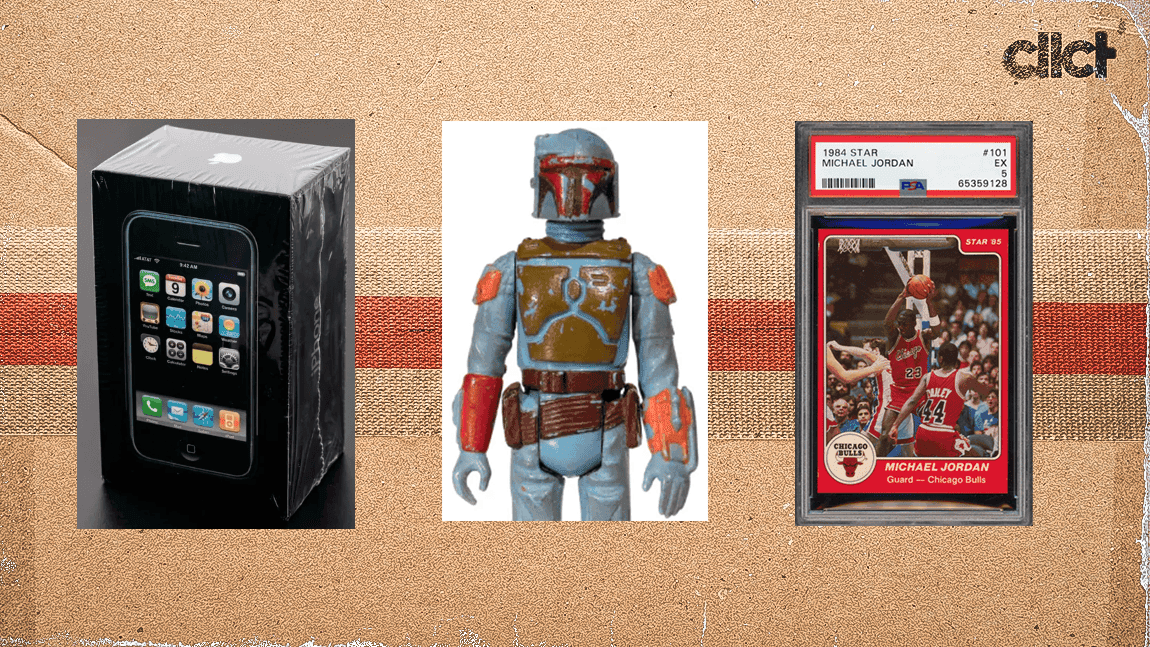

When we see a record-breaking sale or a hyped-up niche, what follows is as predictable as it gets. First come the headlines, stretching beyond collecting circles and intro the mainstream, with high-dollar numbers serving as cannon fodder for clickable headlines. A piece of cardboard sold for how much? A toy is worth what? Somebody paid a year’s rent for a video game?

You get the picture.

Then, inevitably, the category sees a supply shock. What might have been considered rare or novel at first glance upon its initial eye-popping sale soon gives way to an unprecedented number of similar items coming out of the woodwork, hitting the major auction houses, eBay, Facebook groups and the like — quickly altering the perception and, in some cases, the financial reality of the market.

One of the more extreme examples of this phenomenon comes in the sealed iPhone craze.

For those who are unfamiliar, in the past few years, first-generation iPhones sealed in their original boxes emerged as a coveted collectible.

In 2021 and early 2022, examples sold on eBay and in a few auction houses to little fanfare, ranging between the low thousands and low five-figure range. Then, RR Auctions and LCG Auctions sold sealed iPhones for $35,414 and $39,339 in August and October of 2022, respectively, each setting a new record.

Soon, collectors caught on, as did the major auction houses to match demand. After those two sales, auction houses such as Heritage, Goldin and Sotheby’s all joined in. By July 2023, another nine sales occurred at major auction houses, bringing the once-niche collectible into the mainstream and setting the stage for a watershed moment.

LCG sold a 4 GB iPhone, the rarer variant due to its discontinuation months after launch in 2007 (all previous auction house sales had been for 8 GB examples), for $190,373. The previous record for a sealed iPhone was $63,356.40. In other words, the market was broken wide open. Media coverage poured in, with stories from Barron’s, BBC and Business Insider among the outlets weighing in on the sale.

The result?

Suddenly, the rare sealed iPhone appeared at auction more than 15 times in the remaining months of 2023, with six of those sales belonging to the rarer 4 GB, which had previously been seen hardly ever in public sales. In 2024, the supply continued to enter the market, as a couple dozen sales hit the auction block, not including a handful which were pulled prior to sale due to authenticity concerns.

And prices?

Predictably, they have come down to earth.

First, the 8 GBs fell hard. From the peak in 2023, in which four sales eclipsed $50,000, the value has fallen off a cliff. The two latest sales came at the end of September at Goldin, when the auction house offered two examples — one of which came encapsulated with an authenticity guarantee from CAS ($23,180) and the other with noted condition flaws ($9,150) — illustrate a cooling in the market, in addition to an apparent preference for encapsulated copies, a semi-new phenomenon.

If one were to look at just CAS-graded examples, that $23,180 sale is still a major discount from July when Goldin sold another CAS 85+ graded copy for over $40,000.

But the most glaring example of the collapse of the market came last month. Despite the relative glut of 8 GB examples in the market, the 4 GB variant remained comparably rarer and therefore held up far better price-wise. LCG sold one for $130,027.20 in March of this year, around the same time an 8 GB sold for around $20,000.

Yet, even that rarity proved powerless in the face of the cyclical nature of collectible markets, which seemingly move from shiny object to shiny object (even if to return eventually for long term growth).

Goldin’s sale of a 4 GB for just $30,500 — the lowest price on record at a major auction house, was a kick in the gut for the market, which had pinned its hopes on the rare variant holding up against the influx of inventory available in other, more common, variants.

This isn’t about iPhones, however. It’s easily seen across myriad categories.

There has been much said about the pop in the prices for 1984 Michael Jordan Star cards in recent months. While that market has not fallen off a cliff like the iPhone (nor is this a prediction of things to come), the same cycle of a record sale followed by supply coming out of the woodwork has obviously taken place, as Goldin sold more than a dozen copies alone last month. That’s not counting the others appearing more frequently on eBay.

Will the Star market crash? Who knows. So far, the records sales keep coming. As many of the card's supporters will tell you, even if it does, it could still be up orders of magnitude year-over-year and continue on an upward trajectory in the long run. However, the volume resulting from these headline sales is impossible to ignore.

We can look at the rocket-firing Boba Fett prototype, a rare "Star Wars" toy which was seldom seen at auction, particularly in its L-slot configuration, which appeared around six times in public auction records from 2016 to May 2024, when a rare hand-painted example sold for a record-shattering $525,000 at Heritage. Goldin then dropped the hammer with a “Mailer” variant, which sold for $1.34 million, a record for any toy, in August.

Now, if you’ve been following along, you can guess what happened next.

Goldin offered another Fett prototype in its recent Pop Culture auction, this time lacking any of the remarkably rare attributes of the prior two record-setting sales, and it failed to hits its reserve (which is not known), though it was bid up far beyond $100,000 — a price which would have been more than reasonable prior to the Heritage sale.

We also know we will be seeing at least two more hit the auction block this year. One comes courtesy of Hake’s, as the auction house teased it would be coming to the block in a social media post, though did not provide further information. The other will arrive at Heritage, which has an AFA 80 example, with a unique paint scheme and provenance from actor and musician Rick Springfield, currently primed for a December auction

All of this is not to say these specific collectibles are subject to nefarious actors or uniquely volatile in any way. Nor is it truly a commentary on their market.

Rather, it’s a clear look at the obvious: When collectors — in many cases even the longest of long-term holders — see dollar signs in the form of record sales in the category in which they hold assets, they will become sellers in mass.

The result ends up making the collectible so widely available for a time that it’s difficult to argue traditional notions of scarcity remain intact.

Will Stern is a reporter and editor for cllct.