When the iPhone was first released, then-Microsoft CEO Steve Ballmer famously was quoted as saying, “There’s no chance that the iPhone is going to get any significant market share,” adding it was “not a very good email machine.”

He wasn’t alone.

Blackberry CEO Jim Balsillie told Reuters it was just another entrant into a crowded market and hardly represented a “sea change” for the future outlook of Blackberry.

Nokia chief strategist Anssi Vanjoki said Apple would remain a niche manufacturer.

Palm CEO Ed Colligan expressed his doubts on Apple’s ability to pivot from computing to cell phones, explaining, “PC guys are not going to just figure this out. They're not going to just walk in.”

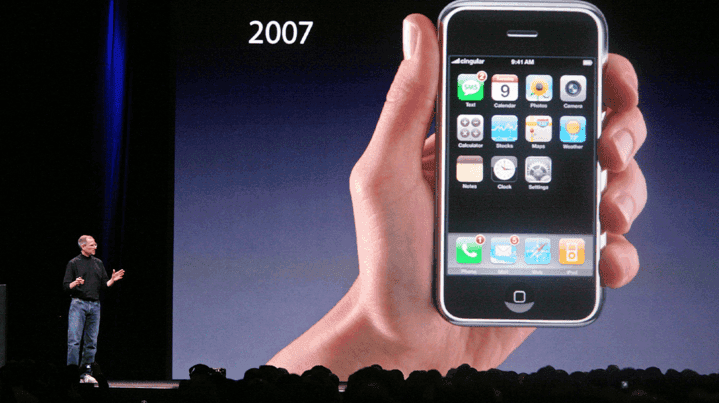

It’s easy enough to spend a full column listing all the people who bet against the newly unveiled product in the summer of 2007, but, truthfully, it wasn’t as if the original release was the obvious slam dunk we now know today.

After all, this wasn’t Apple’s first attempt.

It was only two years earlier when Steve Jobs unveiled the disastrous Rokr, known as the “iTunes phone,” in a press conference in 2005. The Apple CEO’s attempt to woo industry-insiders flopped as he grew visually frustrated as he tried and failed to demo the new device (produced with Motorola) to a live audience, unable to show-off the product’s core functionality of switching between its MP3 players and phone.

To no one's surprise, the Rokr flopped.

But that failure, and Jobs’ vow to never again allow a product development process to occur outside of Apple’s doors, fueled the creation of the iPhone, which went off without a hitch in June 2007.

Apple sold as many as 700,000 units in its first weekend after launch. Two versions were offered to customers: A 4GB ($499) model and an 8GB model ($599). It’s estimated 95 percent of purchases were made up by the 8GB version.

The rest, as they say is history — though, considering you’re likely reading this on an iPhone right now, it might simply be the start of our current era.

However you look at it, the iPhone became the dominant technological device of the century, altering everything from social behavior to the general public’s posture.

With the iPhone’s unmitigated success, in conjunction with the cult-like status of Jobs — which only grew stronger after his 2011 death — it was only a matter of time before collectors developed a taste for the world-shattering tech.

Much like the decades-old collector’s market for Apple products such as the original Apple I, the 2007 iPhone entered the pantheon of tech collecting over recent years as original, sealed copies emerged as a hot ticket item on the auction block.

Why sealed? Two words: Natural scarcity.

More than 6 million iPhone 1s were sold until its discontinuation in the summer of 2008. Far too many to become an expensive collectible. But sealed copies, still unopened all these years later, are impossibly rare. It's only natural.

Think about it, if you bought what at the time was the most advanced piece of technology ever made available to consumers for $500 or $600, the last thing you do is leave it in the box. So, while most people did the obvious thing and immediately tore the seals on the new phone and entered the modern age, an incredibly small few stayed sealed.

Whether an act of extraordinary foresight or happenstance — like one story of a kid who received one as a gift from his parents, only to hide it away in a closet to avoid appearing to flaunt his wealth — it's a near-miracle any exist today.

As with so many collectible markets, video games being a close comparable, it's this accidental scarcity that drives the market.

It took over a dozen years from its release, but 2021 saw sales approaching $10,000 on eBay, sparking major auction houses to take notice, bringing sealed iPhones to market in 2022 and achieving breakout results.

Global searches for the iPhone 1 increased by nearly 20% on eBay in 2023 compared to the year prior, according to data provided to cllct.

LCG Auctions set a world record in July 2023 with a $190,373 sale of a rare 4GB example, which fetch serious premiums over the more common 8GB copies.

We’ve seen choppy waters for the market in the time since, with 2024 sales averaging around half the price of the prior year, despite similar volume hitting the market (on pace to reach around the 27 examples sold in 2023).

Still, top-flight examples, such as the 4GB copies, remain pricey, clearing $130,000 at LCG in March 2024.

As cllct covered in an exclusive report last month, authenticity concerns run rampant, perhaps contributing to a diminished level of demand from would-be bidders who have since lost confidence in the market.

But even as prices appear muted at the moment, they still represent extraordinary premiums for an item once purchased for less than $600.

With two selling at auction this weekend, at Goldin and LCG, respectively, it appears we’re on the precipice of a watershed moment for these collectibles.

Goldin has sold multiple iPhones in recent months, all of which have been encapsulated and graded by third-party authenticator CAS. Heritage has sold CAS-graded iPhones in the past as well. Given the authenticity concerns, such as resealed fakes and questionable seams, expert grading authorities should be a welcome sight in the industry.

CAS has not responded to multiple requests from cllct regarding its processes and an opaque method of authentication.

However, the authentication seems like it might be paying off.

The CAS 85+ graded iPhone at Goldin is nearing $60,000 with a day left of bidding. It’s already the highest bid for an 8GB in more than a year. Exactly one month ago, another 8GB iPhone (ungraded) sold for $11,229 at RR Auctions. Goldin sold a lower-graded CAS iPhone in May for just $9,760.

Notably, this iPhone is a later release, as evidenced by the inclusion of the iTunes icon on the box, which wouldn’t have been added until the app launched in September 2007, three months after the launch.

Before we get into possible rationale for this incredible U-Turn, we need to talk about provenance.

The record-setting $190,000+ iPhone which sold at LCG in 2023 was consigned by an Apple employee who had worked on the original engineering team during the iPhone launch. Why does that matter? Well, in a world where collectors are operating on highly limited information, the most trustworthy piece of information is chain of custody, and who better than someone who was there from the start?

Another wrinkle comes with the current 8GB iPhone being auctioned at LCG, which is accompanied by its original FedEx package, dated and all. The iPhone does not come with a CAS grade, however, it appears to be among the finest looking sealed copies ever offered, with pristine wrapping and only minor box wear.

Also, it comes from the first release, which we know due to the lack of the iTunes icon as well as the FedEx box date, which indicates it was purchased within a week of its release.

All things being equal, one would expect the LCG example to be outpacing Goldin’s, right?

Not so fast.

At the time of writing, bidding sits below $10,000.

If we agree to ignore the higher awareness level of Goldin vs. LCG — which is fair, considering those in the market for an iPhone know of LCG — that leaves the variable of grading.

Could CAS really be such a value-add? Even more than the provenance provided by the LCG shipping container? Not to mention the discrepancy in release dates?

It appears to be the case. Should the current trajectory hold, and the Goldin lot sells for a premium to LCG’s, expect CAS to be receiving phone calls from every major auction house and collector in the industry.

Will Stern is a reporter and editor for cllct.